Latest News

Simplifying Skin Cancer Detection

(TIME) DermaSensor’s titular device is the first of its kind cleared by the FDA for use by non-specialist physicians. It uses optical spectroscopy—the deployment of light to analyze tissues—to promptly detect likely cancerous skin lesions at a rate similar to that of in-person dermatologists.

Read More

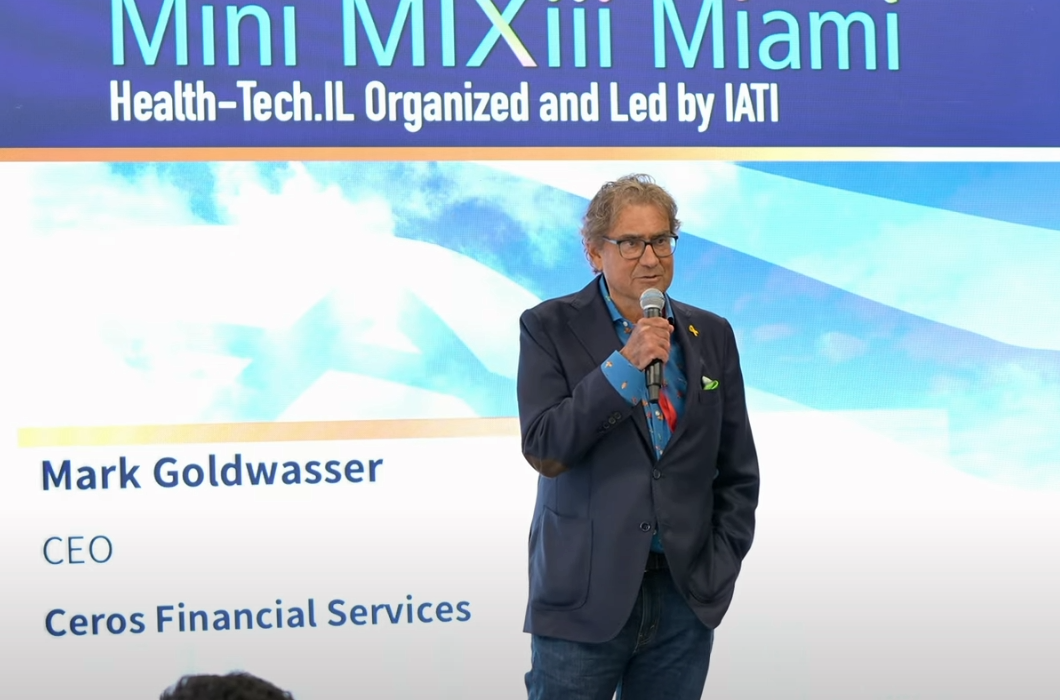

PODCAST: Navigating Crises and Capital Markets: Insights from Mark Goldwasser, CEO of Ceros Financial Services

(Podcast) With over four decades of experience in commodities and securities, Mark shares his remarkable journey from Zimbabwe to the helm of a thriving financial services company. We delve into the dynamic world of capital markets, exploring how Ceros is making an impact in med tech and biotech.

Read More

Ceros Financial Services Arranges $7.5 Million Financing for Wesper

Ceros Financial Services announced that Ceros Capital Markets, its investment banking division, has completed a $7.5 million Series A round for Wesper, which has developed the first clinical-grade FDA cleared platform to bring the full cycle of sleep therapy to home users.

Read More

ProMIS Neurosciences Announces Closing of US $7.4 Million Private Placement

ProMIS Neurosciences Inc. (Nasdaq: PMN) (TSX: PMN), a biotechnology company focused on the discovery and development of antibody therapeutics targeting toxic misfolded proteins implicated in the development of...

Read More

Ceros Financial Services Arranges $15 Million Financing For GT Metabolic Solutions

Ceros Financial Services announced that Ceros Capital Markets, its investment banking division, has completed an approximately $15 million Series A round for GT Metabolic Solutions, which has developed minimally-invasive incisionless bypass technology for bariatric, metabolic and digestive surgery

Read More

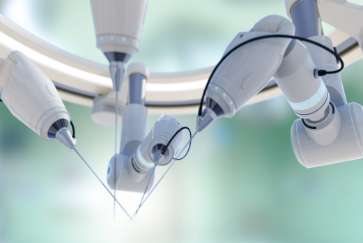

Memic Announces Completion of First Patient Cases Using Hominis® Surgical System in Laparoscopic-Assisted Transvaginal Benign Gynecological Procedures

Patient procedures performed at HCA Florida Kendall Hospital and The Women's Hospital at Jackson Memorial with first and only FDA-authorized surgical robot with humanoid-shaped arms

Read More

Why Ceros Focuses on Funding Medical Technology Start-ups

(InfoMedTechNews) With about $117 million in transactions by the end of 2021, Ceros Financial Services is building an investment banking platform focused on fundraising for early-stage medical technology and medical device companies.

Read More

Robotics Firm Memic Is in Talks to Go Public Via SPAC

(Bloomberg) Memic Innovative Surgery, a medical-device company that specializes in robot-assisted surgery, is in talks to go public through a merger with MedTech Acquisition Corp., a blank-check firm, according to people with knowledge of the matter.

Read More

Memic Raises $96M for it’s Robot-assisted Surgery Platform

(TechCrunch) Memic, a startup developing a robotic-assisted surgical platform that recently received marketing authorization from the U.S. Food and Drug Administration, today announced that it has closed a $96 million Series D funding round.

Read More

Latest New York transplant: $100 million in investments for South Florida medtech companies

(Miami Herald) Latest to join is Ceros Financial Services, a financial advisory group that is raising $100 million over the next 12 months to fund emerging medical technology companies in South Florida and beyond.

Read More

Memic, a Medical Device Company Chaired by Maurice R. Ferré, Raises $96 Million

(Refresh Miami) Memic Innovative Surgery, a medical device company, today announced it has closed a $96 million Series D financing round. The company, based in Tel Aviv and Fort Lauderdale, has another South Florida tie:

Read More