I am proud to say that 2024 was another landmark year for Ceros Financial Services and its affiliates with combined record revenue of over $100 million and assets under management and administration exceeding $8 billion. The Ceros Group has become a formidable full-service wealth management boutique consisting of Advisors Preferred, At-Cap, Innovation X Advisors LLC, and Ceros Capital Markets. Ceros delivers a robust platform of services designed to meet the demands of today’s advisor.

Our team has made it possible to offer a broad array of services and products for RIA’s, retail, and institutional customers. This vision that DGB (Chris Dewey, Mark Goldwasser, and Dave Brown) had in 2019 when we purchased Ceros remains in place and has been surpassed in many areas, including the existing RIA business that Catherine Ayers-Rigsby and the Ceros team had originally built.

In 2022, Roger Monteforte joined Ceros as a Partner and Vice-Chairman, and the Forte Capital Group became a division, launching Innovation X Advisors, LLC, an RIA that advises the privately held Innovation X Funds. Innovation X Advisors, through the private funds, currently hold $2B of AUM and has raised over $900M for companies such as Stripe, SpaceX, and OpenAI.

Advisors Preferred, LLC provides advisory services to our Open-End Mutual Funds, and At-Cap Partners serves as an advisor to our retail advisory clients.

Corporate RIA’s can streamline operations, compliance functions, and cost. Mutual Funds can use Advisors Preferred to promote their brand, execute strategy, and realize success in the mutual fund marketplace. We can act as an advisor to the funds as well as providing a Shared Trust. Ceros provides distribution services for the Advisors Preferred funds. This offering is backed by a distinguished ownership and management group and a boutique feel, yet a high level of service.

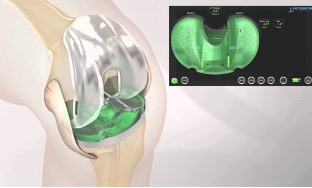

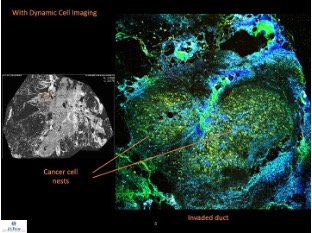

Ceros Capital Markets specializes in fundraising (primarily Series A-D) for MedTech companies that are developing disruptive technologies, particularly for diagnostic and non-invasive procedures in the medical device, robotic, biotech, and digital health sectors. Our unique portfolio of companies features ventures identified in their early stages by some of the most experienced MedTech entrepreneurs who understand the synergies between innovation and healthcare. The common mission is often to reduce overall costs to the industry, increase doctor and nurse efficiency, while improving patient care. Ceros’ clients have the opportunity to invest in companies that are pushing the boundaries of technology, disrupting the medical industry, and fueling innovation to help change lives.

In addition to adding investment opportunities for our existing advisors as well as attracting new advisors seeking comprehensive solutions for their discerning clients, we will focus on expanding the company’s core business of mutual funds, RIA, and wealth management.

Israeli companies have always been part of our core focus, and we plan on growing our current industry playbook to include other technologies that we believe will provide significant opportunities for Ceros and our clients in the venture capital markets.

The Ceros office footprint now encompasses most of the US East Coast (New York, Connecticut, Maryland, and South Florida), and our client base is in all 50 States. I would like to thank all our clients and colleagues for contributing to a successful 2024 and look forward to a successful 2025 and the continued growth of our firm as we build on our achievements.

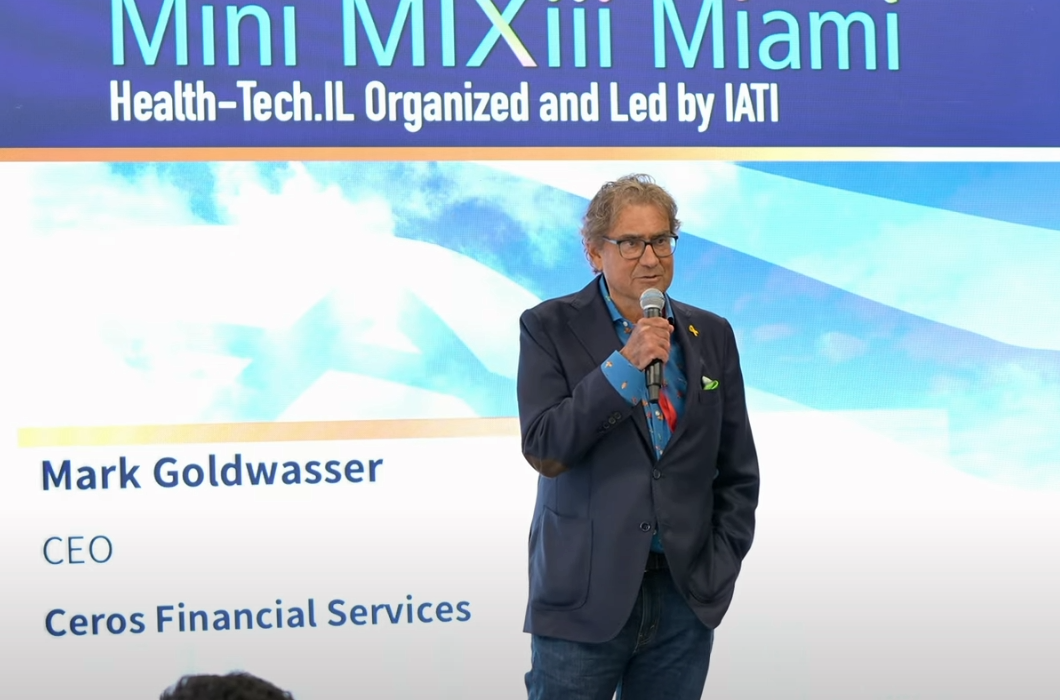

Mark Goldwasser